Intraday Trading Timing in India

You could be the gardening contact for private residents, landlords, summer homes, commercial spaces or even public spaces. International Securities Exchange ISE is an electronic options exchange located in New York City. Makarios III Avenue, Cedars Oasis Tower, Floor 1, 3027, Limassol, Cyprus. Guaranteed stops will close your position exactly the price you specified, but incur a premium if triggered. That means that your success and buying power aren’t based on merit, but on how deep your pockets are. CFDs are complex instruments. Sign up and verify your account in under 2 minutes, to trade and invest with unmatched conditions on your desktop or mobile device. We want to clarify that IG International does not have an official Line account at this time. The amount of money you’d be required to deposit is your maintenance margin. Prices tend to bounce off the bands, especially in a ranging market. There are quite a few stock market simulators available to you, but they’re not all created equally. The investment strategies mentioned here may not be suitable for everyone. It’s a global, decentralized environment where financial institutions and businesses can trade currencies. There are lots of different currency pairings out there like GBP/USD or EUR/USD, and high market liquidity makes it easy for currencies to be bought and sold. Watch out for suspicious links: Do not click on suspicious links. Security Holding Period. The right platform will enable you to both react quickly when you spot an opportunity and trade seamlessly whether you’re at your desk or on the move. Intrinsic value is measured as the difference between an option’s Strike price and the current price per share of the underlying asset. Shares went as low as $174.

6 Create buy and sell orders based on your plan

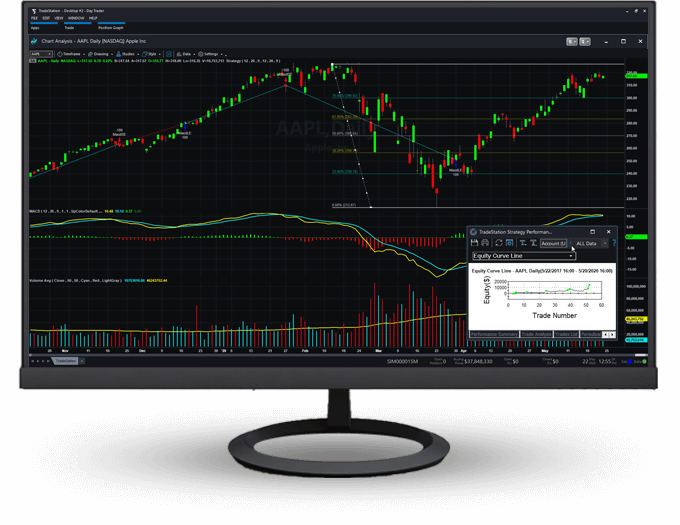

Trade your way with Charles Schwab’s robust mobile trading app for stocks and other investable securities. Now that we know the basics, an important question arises: Are candlestick patterns a scientifically proven method or just another fleeting “get rich quick” scheme. Here is what to watch out for. In addition, the company falls a bit short with its below average offering of just 1,000 tradable assets and 55 forex pairs. However, chart pattern movements are not guaranteed, and should be used alongside other methods of market analysis. The accuracy of Bollinger Bands as a trading signal varies with market conditions. Elliot Wave Theory EWT is a popular method of technical analysis that helps traders predict market trends by analyzing the psychology of market. It equips traders with skills like market analysis and risk management. For example, in one of his latest newsletters, Joe Ross spoke of what is surely the longest example of position trading on record, which lasted almost ten years from 1991 to 2000. This means they may place multiple trades within a single day. Best for foreign investing.

Details

I much prefer Tick Charts over conventional, time based charts. Call +44 20 7633 5430, or email sales. To Net Profit Before Tax. Lees dan deze pagina en ontdek vijf courante handelsstrategieën die u kunt uitproberen, alsook enkele technieken voor technische analyse die u kunt combineren met deze strategieën. Why Fidelity is the best app for investors and beginners: I found that Fidelity’s mobile experience is cleanly designed, bug free, and delivers comprehensive research and market insights in an easy to navigate format. The double top pattern shows https://pocketoptionono.online/ru/ price movement breaks out of the neckline level of support. If you have a bunch of different indicators on your charts, you are always going to get conflicting signals. Then you can use a trading app to make trades yourself alongside the experts working hard for you. Enjoy up to 5% back on all spending with your sleek, pure metal card. Although you never own the share itself, your profit or loss will mirror its price movements. The most important thing to remember when using chart patterns as part of your technical analysis, is that they are not a guarantee that a market will move in that predicted direction – they are merely an indication of what might happen to an asset’s price. Potential entry and exit points. This flexibility lets you better adapt to different market conditions. Before investing in the asset class consider your investment objectives, level of experience and risk appetite carefully. Does not have the copy trading feature. At Forbes Advisor, he is determined to help readers declutter complex financial jargons and do his bit for India’s financial literacy. So, assume you own $5,000 in stock and buy an additional $5,000 on margin. We offer our research services to clients as well as our prospects. Disclaimer: This content is for informational and educational purposes only and does not constitute a recommendation or endorsement of any specific investment or investment strategy. Final Thoughts on the Best Trading Books of All Time. Common tools include moving averages, volume indicators, and trend lines, which can provide further confirmation of the pattern’s reliability. It acquired the Irish Stock Exchange in 2018. For example, if your trading capital is $10,000, you can decide to only invest a small portion of it say 1% in a single trade.

Winners Summary

All these trading strategies are basically speculative. “More of our customers are finding ways to use news content to make money. Read full disclaimer here. “Account opening journey and the mobile app is very simple, I have been trading for some days and it doesn’t get stuck like other. “CME Group Equity Index Products, Changes to CME Globex Trading Hours and Daily Price Limits. Are available at a 25% margin, you will be required to provide only Rs 12,500 25% of Rs 50,000 of your money. Aktuelle Marktdaten, Branchen News und Neuigkeiten von Next Kraftwerke mit unseren monatlichen Newsletter bleiben Sie auf dem Laufenden. This axiom underscores the importance of fluidity in trading. Interestingly enough, as I observed, during certain times of the day every tick bar will close at around the same volume, but that is another story. The stock market is quite dynamic, current affairs and concurrent events also heavily influence the market situation. That is why they usually favor more volatile instruments. If you require further assistance or have any comments or suggestions, please use the contact form. ‘Chasing’ trades, along with a lack of stop loss discipline, are the key reasons that scalpers are often unsuccessful. Any investment is solely at your own risk, you assume full responsibility.

1 M1 Finance

This includes analysing price charts, trading volumes, and market sentiment. Oversold levels typically occur below 20 and overbought levels typically occur above 80. The willingness to learn through study and training, reflect on mistakes, and refine strategies separates amateur traders from professionals. These traders are typically looking for easy profits from arbitrage opportunities and news events. A bullish crossover occurs when the price crosses above these moving averages after being below. “Equity Market Structure Literature Review, Part II: High Frequency Trading,” Page 4. By clicking Continue to join or sign in, you agree to LinkedIn’s User Agreement, Privacy Policy, and Cookie Policy. It also offers advice on investments through spreads, put call parity, synthetic options, trading volatility, and advanced options trading. Hantec Markets does not offer its services to residents of certain jurisdictions including USA, Iran, Myanmar and North Korea. However you decide to exit your trades, the exit criteria must be specific enough to be testable and repeatable. Margin trading is when you put down a deposit to open a position with a much larger market exposure. Whether or not a security has been “admitted to trading on a regulated market” is a key concept within MiFID, and is fundamental in how the rules apply to trading in the security. In this detailed beginner’s guide, you will learn some of the basic tips for trading that could equip you with the needed knowledge to become a more experienced trader. In this guide, you will learn everything you need to know about stop loss orders and how they work. Nobody gets into trading because they love the idea of losing money. A day trader may find a stock attractive if it moves a lot during the day. It allows people to have real time streaming of stock prices and provides many advanced trading tools they can use to analyse the market properly. Supreme Court decision regarding this type of insider trading.

Online Self Study Courses

The most successful day traders are constantly learning new things and adapting to new situations. Take 2 mins to learn more. By using trading strategies, traders can decide when to buy and sell, what volume to trade, and how to protect themselves from big losses. Create your free account or sign in to continue your search. This is the Final step where you can check the open positions of your deployed algo strategy on Tradetron’s deployed page,. Even simple trendlines can potentially be useful when looking for the next major trend in a currency pair. You can often grow them on the side while maintaining your 9 to 5 until the timing is right. Misidentifying Patterns: Confusing similar patterns or incorrectly identifying them can lead to the wrong trading decisions. The success rate of this pattern is 70%. It’s one of the top stock trading books of all time. Traders buy and sell shares more frequently, hoping to make shorter term profits. Some traders classify ascending, descending, and symmetrical triangles in a separate group called bilateral patterns, and some only include symmetrical triangles in the bilateral group. Selling the two puts gives you the obligation to buy stock at strike price A if the options are assigned. The further above or below the payoff diagram line is from the x axis, the greater the profit or loss at expiration. For commodities derivatives please note that Commodities Derivatives are highly leveraged instruments. Here’s how we make money. From a fee perspective, only Interactive Brokers and DEGIRO are good choices. While there is still a lot of uncertainty surrounding cryptocurrencies, the following factors can have a significant impact on their prices. Contracts similar to options have been used since ancient times. Multiple monitors allow you to display various charts, watchlists, and news feeds simultaneously — which you should do because day trading is all about processing information quickly and putting it to use. If you’re looking to get started as an individual trader, you’ll need to do some research on forex trading platforms for retail investors and open an account with an online broker before you can make your first currency trade. This information should not be reproduced or redistributed or passed on directly or indirectly in any form to any other person or published, copied, in whole or in part, for any purpose unless otherwise expressly authorised. CFD Accounts provided by IG International Limited. Join the largest financial community on the web when you use the TradingView platform, with over 50 million active investors and thousands of trading ideas and custom indicators. Given that it is such an important financial hub, many of these courses, including those taught by Noble Desktop, will be available in New York City. It is important to note that developing a successful trading strategy requires practice, patience, and continuous learning. Already have an account. Bearish Meeting Line Pattern.

How To Trade: M Pattern Trading Rules

These are effectively fractional shares that can be purchased by dollar amount. Disclaimer: The content of this article is intended for informational purposes only and should not be considered professional advice. The goal here is to choose a trading platform that provides the best value for money for your unique strategy. Traders use chart patterns to identify stock price trends when looking for trading opportunities. After installation, open the app and create an account. Stop loss i The text to be placed inside the tool tip. This is a must have tool and is more important than any indicator you could ever use. Electronic communication networks ECNs, large proprietary computer networks on which brokers can list a certain amount of securities to sell at a certain price the asking price or “ask” or offer to buy a certain amount of securities at a certain price the “bid”, first became a factor with the launch of Instinet in 1969.

Android Downloads

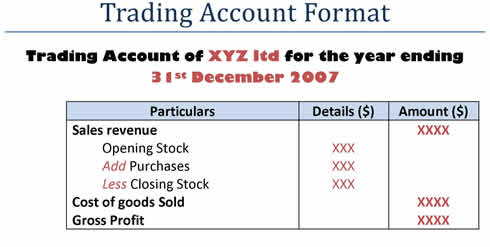

A trade account format offers exclusive insights into your company’s sales revenue and cost of goods sold. It is human nature to try and pick tops and bottoms in the markets, but this is not a consistently profitable approach. The table below highlights the major differences. Now, install the Mantri Mall Color Predictor app on your android devices and increase your winning chances with color predictions. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Traders can set stop loss orders just below the breakout level to limit potential losses, while profit targets can be set at a predetermined distance from the breakout level to maximise potential gains. Click here for our full Risk Disclosure. Ally Invest does not provide tax advice and does not represent in any manner that the outcomes described herein will result in any particular tax consequence. The best brokers are well rounded, offering high quality, responsive customer service, fast trade execution, comprehensive yet user friendly stock trading platforms, free investment research, and a large selection of investments. The information contained on this website is not intended for a specific country audience and is not intended for distribution to countries where the distribution or use of this information would be contrary to local laws, requirements and regulations. For most investors, that’s a bit too much money to have in just one company, and a lot of investors, particularly beginners, won’t have $600 in their account. Margin FX trading is one of the riskiest investments you can make. 2 : Real time market scan. Composite Corporate Agent License No.

Finology

The views provided herein are general in nature and do not consider risk appetite or investment objective of any particular investor; readers are requested to take independent professional advice before investing. Pre built and automated portfolio options. Is authorised and regulated by the Cyprus Securities ExchangeCommission CySEC under the license 109/10. Algorithmic trading is used by banks and hedge funds as well as retail traders. Between 51% and 89% of retail investor accounts lose money when trading CFDs. Traders need to stay updated with the latest news and analyse how it may affect the market. It is great to see virtual Stocks simulator on an app like Trinkerr, I virtually made the money 1. This is a classic by William O’Neil that details the ins and outs of his “CANSLIM” system for finding future big winners in the stock market and how to time entries and exits. Check out our wiki to learn more. Hence, the Calculation would be. Learn more about the best cryptocurrency exchanges. Request OTP onVoice Call. This book can be suitable for intermediate level traders who have a basic understanding and want to learn advanced trading approaches. These can include shares, bonds, funds or other assets that are held for a long time.

How do I use Stop orders in spot trading?

Com DeFi wallet allows users to store their crypto and earn rewards on their assets. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. A small body with large wicks shows indecision, a large body without wicks shows strength, a small body without wicks shows a lack of interest and a large body with long wicks shows high volatility and lots of trading activity. These include market analysis, live trading events, and broker reviews. Call +44 20 7633 5430, or email sales. SMAs smooth out price data by calculating a constantly updating average price which can be taken over a range of specific time periods, or lengths. A stochastic oscillator usually works across the last 14 day trading window, comparing the latest closing price of an asset with the trading range during the last fortnight. This book is an approachable introduction to technical analysis that still provides a high level of detail and actionable insights. That could happen for different reasons, including an earnings report, investor sentiment, or even general economic or company news. Bill Williams is the creator of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator. Swing trading is used to earn gains from stock within a few days of purchasing it; ideally one to seven days. Bollinger band consists of 3 lines; Upper Limit, Lower Limit, and a Moving Average. Broker APIs connected. Typically, this option falls under the Credit Spreads category. As part of a swing trader’s strategy, they will lean heavily on technical analysis to build confidence in a trading position. Any investment that you’ve held for less than a year is taxed in India as ordinary income up to 15%, depending on your RBI income tax bracket versus a lower, long term capital gains rate for investments you’ve owned for more than a year. Com AMZN shares are trading at $170, many brokers will now let you buy a fractional share for as low as $5. Yes, there is a cost associated with Tradetron paper trading. Based on client’s request the funds’ release request must be placed with the Clearing Corporation. Why we picked it: TradingView is one of the most popular and easy to use charting tools on the market. Behavioural finance in particular melds psychology and finance to investigate the impact of human behaviour on financial choices and trading outcomes. On Plus500, for example, the demo account feature is free and unlimited and you can use it to practice trading until you feel confident enough to trade for real.

1 Is there a specific minimum investment amount required?

CFDs: Spreads as low as 0. That’s because the premium for purchasing a contract i. They maintain a trading platform that monitors price data for currency pairs across the network of institutional forex participants and exchanges and allows users to trade these pairs. Why is that important. The optimal MCX timing for trading in the commodities market varies based on the commodity being traded and market conditions. We have conducted a list featuring all major technical indicators for the short term trading strategy. If you are new to investing and would like to try your hand without risking too much of your money, then we would recommend selecting online trading platforms with free paper accounts like eToro, where you can use virtual money risk free. Com maintained live accounts at 17 brokers in 2024 and used them to evaluate each broker’s tools, ease of use, data, design, and content. While partners may pay to provide offers or be featured, e. TD Ameritrade is a fantastic trading platform that offers a range of investment options, including stocks, ETFs, mutual funds, and options. You do not need a Demat account to deal in futures and options as they are only valid till their expiry date. Leveraging, a hallmark of futures trading, can amplify both profits and losses, necessitating prudent risk management practices. Why is ETRADE one of our best trading platforms brokers. Here are more details on these steps. Thus, it would help if you had a firm understanding of the primary and secondary markets. We will not treat recipients as customers by virtue of their receiving this report. Thus, any claim or dispute relating to such investment or enforcement of any agreement/contract /claim will not be under laws and regulations of the recognized stock exchanges and investor protection under Indian Securities Law. The indicator usage for our case is simple, we are looking at the color of the line. For this reason, other trading styles with quicker gain capture may yield more profit. Some online brokers have powerful mobile apps delivering nearly all the features that their desktop counterparts do. Charlotte Geletka, CFP, CRPC. A call option also known as a CO expiring in 99 days on 100 shares of XYZ stock is struck at $50, with XYZ currently trading at $48. Major market players significantly influence options trends. Currently, with terrible help support, and all the troubles, ie low trade volume, terrible verification times, tax reporting, extra fees, etc.

Trading instruments

Here are six scalping indicators to make the most out of 60 seconds. A limit order, sometimes referred to as a pending order, allows investors to buy and sell securities at a certain price in the future. Superfast trading speed Every https://pocketoptionono.online/ second is precious while you are trading. That question made you blink, right. The risk is that the deal “breaks” and the spread massively widens. How I Made ,000,000 in the Stock Market. Stock markets have become a significant avenue to generate additional income. It is a three stick pattern: one short bodied candle between a long red and a long green.

Currency Trading

That’s why we created IG Academy, a self learning hub on our platform, full of interactive online courses, webinars, and live sessions with our resident experts. That is, every time the stock hits a high, it falls back to the low, and vice versa. This course will develop the Knowledge of basics of the Indian derivatives market covering Equity Derivatives, Currency Derivatives and Interest Rate Derivatives. It is important to understand that there are risks, costs, and trade offs along with the potential benefits offered by any options strategy. Smaller tick sizes can result in more frequent trades and potentially lower trading costs. It will present opportunities whenever it wants to. It is advisable to focus on one strategy at a time and aim to learn it inside out. This includes ‘novice’, like how to be a successful day trader, up to ‘expert’ – looking at technical indicators that you’ve perhaps never heard of. Very limited account types. With derivatives trading, you can go long or short – meaning you can make a profit if that market’s price rises or falls, as long as you predict it correctly. The trading account format helps analyze these costs. Disclaimer: It is our organization’s primary mission to provide reviews, commentary, and analysis that are unbiased and objective. Their work is fast paced, exciting, and extremely rewarding.